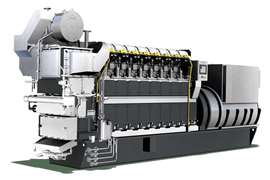

Dual-fuel engines will form part of a diesel-electric propulsion system on board the vessel

Can charge EV truck or bus with large battery capacity at 460 kW within two hours

Volvo Construction Equipment reveals its financial results for Q1, 2024

New heavy-duty truck manufacturing plant in Mexico will supplement U.S. production

Yuchai Heavy Industry has unveiled a number of electric skid steer loaders

Sponsored Content

See why the compact but mighty John Deere 4.5L Stage V industrial engine was the right solution to power Gunnar Guldbrand A/S’s custom truck solution for horizontal directional drilling customer Eco Drilling.

In this second installment of a three-part series on what makes a facility “state-of-the-art,” we examine a philosophy related to cutting-edge plant floor technology: smart manufacturing.