Epiroc releases SmartROC T30 R remote drill rig

Engines with SCR and DPF aftertreatment system approved to meet standards

New production line will produce electrified solutions for mobility applications

Boliden, Epiroc and ABB deployed system on test track in Sweden

Achievement marks fourth time company has broken thermal efficiency record

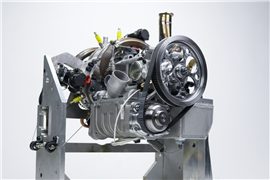

Gen set features the HVO-compliant KD18L06 diesel engine

Sponsored Content

See why the compact but mighty John Deere 4.5L Stage V industrial engine was the right solution to power Gunnar Guldbrand A/S’s custom truck solution for horizontal directional drilling customer Eco Drilling.

In this second installment of a three-part series on what makes a facility “state-of-the-art,” we examine a philosophy related to cutting-edge plant floor technology: smart manufacturing.